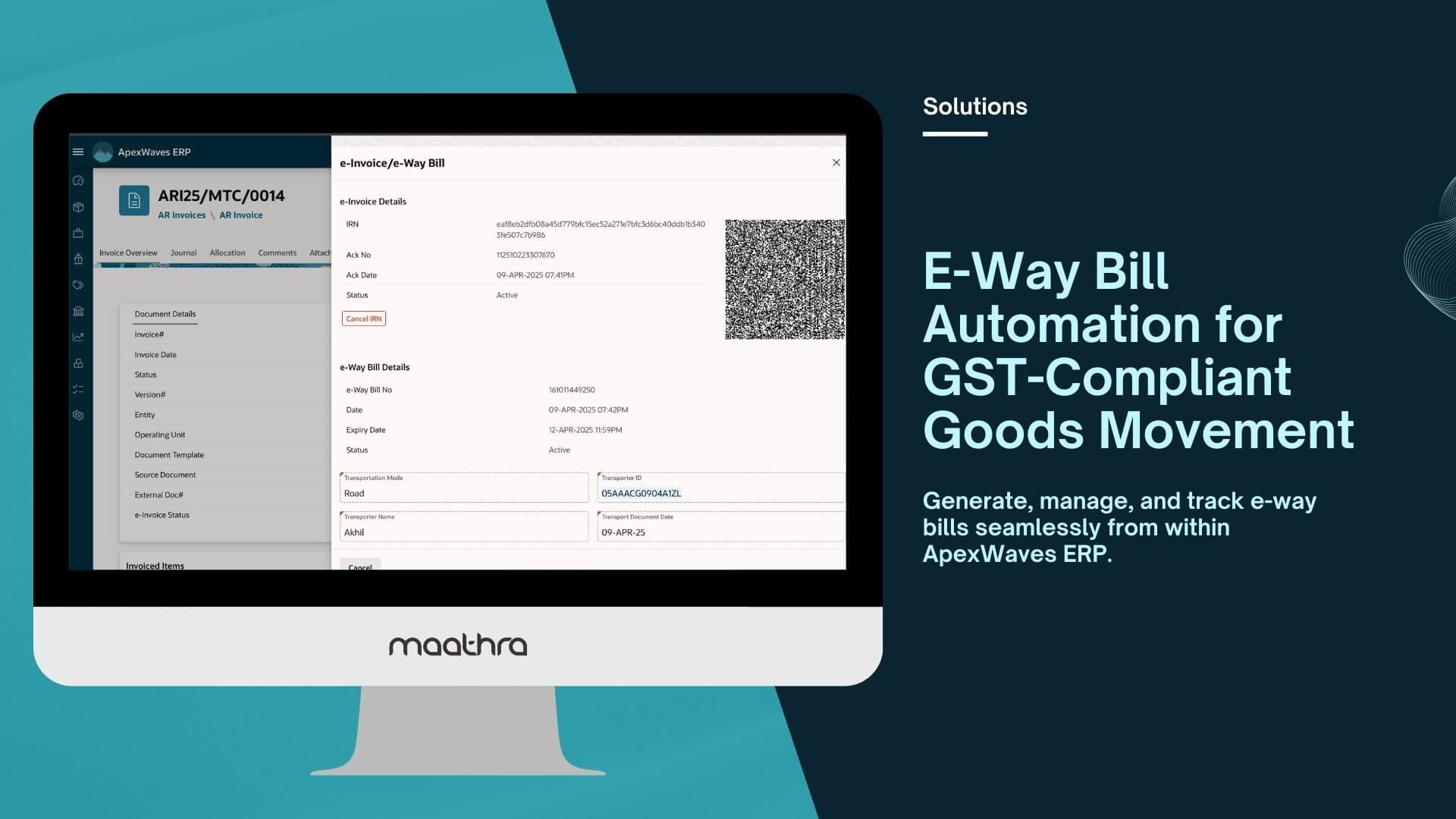

E-Way Bill Automation for GST-Compliant Goods Movement

Generate, manage, and track e-way bills seamlessly from within ApexWaves ERP.

Any

E-Way Bill

Overview

Under GST regulations, an e-way bill must be generated before transporting goods beyond prescribed limits, capturing invoice, transporter, vehicle, and distance details accurately. Managing this process outside the ERP often leads to duplicate data entry, mismatches, and compliance risks.

ApexWaves ERP simplifies e-way bill compliance by integrating e-way bill generation and lifecycle management directly into the system. Built on Oracle APEX and Oracle Database, the module connects securely with government-approved GST Suvidha Providers (GSPs) to ensure lawful and reliable processing while keeping the user experience fully within the ERP.

E-way bills can be generated automatically from approved invoices, delivery challans, or stock transfer documents. Transporter and vehicle details are captured once and reused across transactions, reducing effort and errors. All updates, cancellations, and validity checks are handled within defined regulatory timelines.

Key Capabilities

- Integrated E-Way Bill Generation

Create e-way bills directly from invoices or delivery documents without leaving the ERP. - Transporter & Vehicle Management

Manage transporter IDs, vehicle numbers, and transport modes centrally. - Validity & Distance Handling

Automatically applies GST-defined distance and validity rules. - Updates & Cancellations

Supports vehicle updates, transporter changes, and cancellations as per GST guidelines. - Real-Time Visibility

Track e-way bill numbers, validity status, and processing responses in one place. - Audit & Compliance Readiness

Maintains a complete transaction history for audits and internal controls.

Business Benefits

- Ensures compliant movement of goods under GST

- Eliminates manual portal dependency

- Reduces dispatch delays and operational overhead

- Improves accuracy across finance and logistics teams

- Scales for high-volume, multi-location operations

Who This Is For

- Manufacturing organizations

- Distribution and trading companies

- Businesses with frequent inter-state or inter-branch movement

- Enterprises seeking tighter GST compliance controls

E-way bill automation in ApexWaves ERP transforms a mandatory compliance task into a streamlined operational process. By embedding regulatory workflows directly into the ERP, businesses gain efficiency, accuracy, and confidence in every goods movement.

Transform your business with us

Need a similar solution? Let's discuss how we can implement E-Way Bill Automation for GST-Compliant Goods Movement for your organization.

Explore More Solutions

Discover other ways we can help you grow.