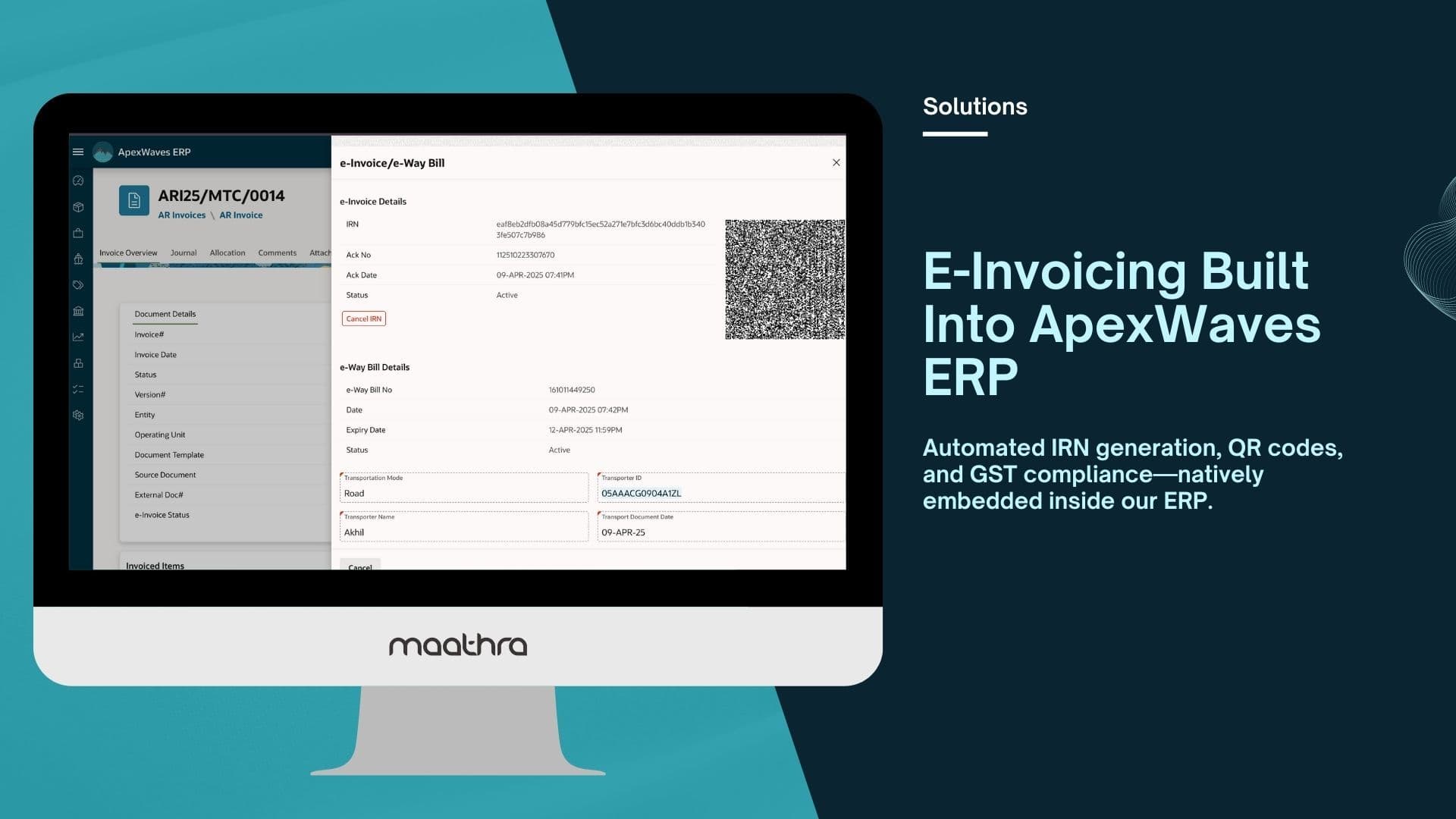

E-Invoicing Built Into ApexWaves ERP

GST-compliant e-invoice generation using government-approved GSP APIs—securely embedded in our ERP.

Any

E-Invoicing

Overview

India’s e-invoicing framework requires businesses to generate an Invoice Reference Number (IRN) and signed QR code through the government-approved ecosystem. Since direct NIC access is restricted, ApexWaves ERP leverages certified GST Suvidha Providers (GSPs) to ensure lawful, reliable, and scalable e-invoice processing.

The e-invoicing module in ApexWaves ERP is built on Oracle APEX and Oracle Database, and integrates seamlessly with GSP APIs using secure REST services. Invoices generated in the ERP are automatically validated, transmitted to the GSP, and returned with IRN and QR code details—fully embedded into the invoice record.

Key Capabilities

- Authorized GSP API Integration

Seamless integration with NIC-approved GST Suvidha Providers for IRN generation, cancellation, and status checks. - Automated IRN & QR Code Retrieval

IRN, signed QR code, and acknowledgment details are fetched automatically upon invoice confirmation. - Pre-Submission GST Validation

Validates mandatory fields, GSTINs, tax breakups, and HSN/SAC data before sending requests to the GSP, reducing rejections. - Real-Time Status & Error Tracking

View submission status, API responses, and error messages directly within ApexWaves ERP. - Complete Audit Trail

All e-invoice requests, responses, and user actions are logged for compliance, reconciliation, and statutory audits. - Multi-GSTIN & Multi-Entity Support

Supports multiple GST registrations, branch-level invoicing, credit/debit notes, and configurable numbering schemes. - GSP-Agnostic Architecture

Designed to switch or support multiple GSPs without disrupting ERP workflows.

Benefits for Your Business

- Fully compliant with India’s e-invoicing regulations

- No dependency on manual uploads or external portals

- Reduced invoice rejections and processing delays

- Scales efficiently for high invoice volumes

- Keeps finance and compliance operations centralized

Ideal For

- Enterprises using ApexWaves ERP

- High-volume invoicing businesses

- Organizations with multiple GST registrations

- Companies preparing for audits and GST scrutiny

E-invoicing in ApexWaves ERP is engineered to handle regulatory complexity transparently. By working with authorized GSPs and embedding compliance directly into the ERP workflow, we ensure reliability, scalability, and peace of mind for growing businesses.

Transform your business with us

Need a similar solution? Let's discuss how we can implement E-Invoicing Built Into ApexWaves ERP for your organization.

Explore More Solutions

Discover other ways we can help you grow.